On August 7th, 2020 at about 10am I signed on to the Canvas course software, spent a little more than an hour taking a final exam about real estate investment, and then signed off for the last time. Over the last year and a half, I had done something very impressive in most people’s estimation: I had earned a Master’s Degree in Finance from Harvard. Technically, it’s a Master’s in Liberal Arts: Finance from Harvard University Extension School. The Extension School is Harvard’s online/offline hybrid program, offering a couple dozen different degrees and graduate certifications.

The first question people tended to ask when they found out I was working on a Harvard degree was “How in the world did you get in?!”. It’s a very valid inquiry. Harvard is famous for its selectiveness, taking just 4 percent of undergrad applicants each year. I won’t pretend that I’ve ever been an all star student. I completed high school with roughly a 3.5 GPA, and then earned even lower than that in my undergrad studies at Boise State University. Most of Harvard’s schools wouldn’t have looked past the first few lines in my application. The Extension School is unique because it has an “earn your way in” approach to admissions. Basically you take the first three classes, and if you do well, you can continue with the program. This means that they have a 100% acceptance rate in the sense that anyone can sign up for a class, but very few (from my understanding a low single-digit percentage) go on to actually graduate from their programs.

The next question I got a lot is why I wanted to dedicate so much time and money to this? It was an especially good question given I’m an entrepreneur and wouldn’t get any obvious career benefits from the degree. It was a hard decision to make, but ultimately these were the most important factors:

- A Master Degree (especially from Harvard) has value. It would definitely be a contributor to stacking the odds in my favor for long-term success. In economic speak, it was a positive expected value decision.

- The (mostly) online program made it very accessible. I could stay in Boise, continue running my businesses and living my life the way I wanted to while earning the degree.

- The program itself was filled with classes I was extremely interested in, and I hoped to learn a lot that I could use for myself and my business/investments.

This first of three articles will review the program itself and talk about my favorite classes. Let’s jump in:

Program Review: Five Stars

Overall, I would recommend this program highly for almost anyone seeking a Master’s Degree in one of the subjects available (see the list here). The classes I took that were poor were more than made up for by the classes that were great. The finance program itself suffers from the inherent problems of the financial field, most of which come from trying to make it into a hard science, which simply isn’t possible. I have a whole upcoming article dedicated to that topic. For now, here are the biggest positives of the program:

On-Campus Experiences

I traveled to Cambridge four times for this program. Three were on campus weekends that involved about 16 hours of class over the course of three days. I thought this was a very effective format for a class, allowing students to get a good base over the semester through the online classes and then having an intense, in-depth discussion all at once about the topic.

I also did a January term class that involved three weeks of class for three hours per day. Again, the abbreviated schedule and focused learning was incredibly effective. This was also the period of time that I got to explore Cambridge and the greater Boston area. It would be hard to get the full feel of it without being a student, but there is an amazing amount of intellectual power located within a few miles in that area thanks to hosting Harvard, MIT, Tufts, and an incredible 49 other educational institutions within the metropolitan area.

Cost-to-Value Ratio

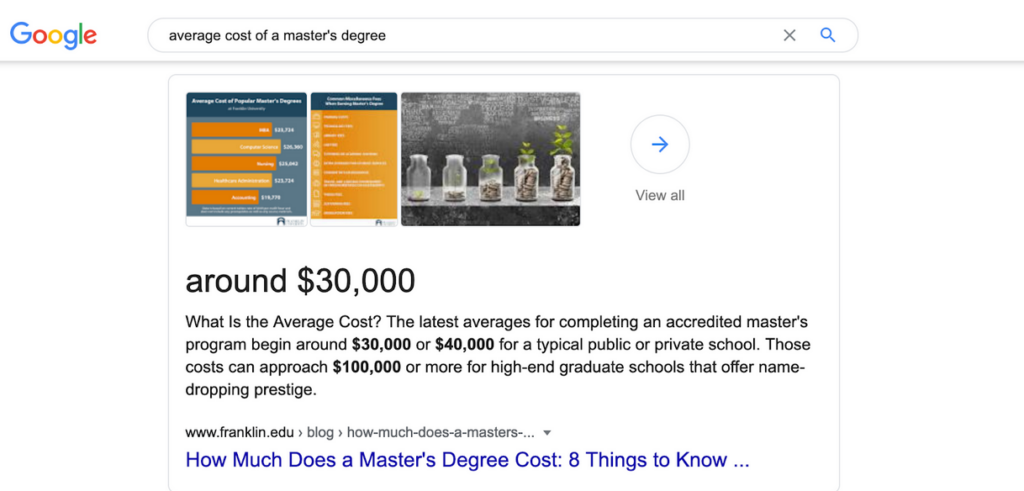

The listed cost of the entire program is approximately $35,000 for tuition. I would estimate that by the time I include books and the four trips to Boston (including the three weeks in January in a hotel) I spent a little bit over $40,000 in total to earn this degree. Now that falls roughly in line with the average for a master’s degree:

However, it’s important to note that this was absolutely not your average Master’s Degree program. First off, the educational quality was certainly world class (more on that next). Second, Harvard is unquestionably the most prestigious educational institution in the US, and arguably the world. Most of their graduate programs, as the above mentions, run well into six figures in cost. Considering that you can get a Master’s Degree from Harvard for $40,000 (less if you live in Boston), I would say that the Extension School has unquestionably the best cost-to-value ratio of any graduate level program. Dollar for dollar, I simply haven’t seen anything that comes close to matching it.

Great Classes Ratio

Easily the most important distinction that I noticed between Harvard and Boise State (and presumably almost all schools of such calibers) is the difference in the number of classes that were valuable and high quality. In my undergrad, I felt like I wasted a lot of my time. Most of the classes were useless, poorly taught, structured ineffectively, or just not applicable to real life in any way. I would say around 10% of the classes I took I actually got value out of and/or were taught well.

Fast forward to Harvard, and it still holds true that there were classes that were poorly taught or had little value. In fact, a couple of the worst classes I’ve ever taken were at Harvard. However, the percentage of good classes was much higher, I’d say 50%, with three out of the twelve being three of the best classes I’ve ever taken.

The first three classes I took were the “earn in” portion of the program. They were more entry-level, principles classes, taught very effectively and designed to weed people out. Overall they were good but not necessarily memorable. The remaining nine classes can be broken down into three categories: The Good, The Bad, and The Dangerous. The Bad classes were truly bad, no way around it. So bad in fact, that I don’t think they’re worth writing any more about. The Dangerous classes will get their turn in my next article. But there were three classes that I took that were legitimately great classes. All three offered tremendous learning value and were everything I would expect of the country’s oldest and best educational institution.

Three World Class Classes

Business Strategy in the Real World

In order to get some semblance of a true on-campus Harvard experience and to speed up my program, I decided to do a three-week January term class on campus. I saw this class as just fulfilling a requirement and thought most of the value I would get would be from being in Cambridge for three weeks, but I was completely wrong. It turned out to be a great class with excellent content.

Dr. Daniel Deneffe both created the curriculum and taught the class. His entire career has been in management consulting and that is what this class was based around: looking at a company from an outsider’s perspective and coming up with a set of recommendations for it, or as an insider making a strategic decision. The course was based around Dr. Deneffe’s book, Fad Free Strategy.

Behavioral Economics and Decision-Making

I was stoked about this class the second I saw the title. The class was co-taught by David McIntosh and Jon Fay, and they brilliantly used real non-fiction books instead of academic papers or textbooks (why don’t more professors do that?). The books were excellent reads and several of them I’d had on my list anyway, so I was actually motivated to go above and beyond with the class reading. The subject of behavioral economics is loaded with gems of practical knowledge. In the class we discussed a wide range of irrational and illogical behaviors that people tend to exhibit when making decisions. The real value in this course and in studying this subject is that when you know about these behavioral biases, you can catch yourself before making poor decisions.

Real Estate Investment Principles

It’s rare that a teacher exhibits maximum effort to make a class truly great. Teo Nicolais did that and then some with his Real Estate Investment Principles class. Unfortunately this was the last class I took for my degree and I didn’t get to do any more with him, but I’m sure his entire suit of real estate investment classes (which culminate in a certificate) are excellent.

Teo laid out a framework for analyzing real estate purchases, which is by far the most important part of the process. In investing, you make your money when you buy. This class went in depth on practical examples of analyzing real world properties, and provided templates that I can use for the rest of my life. It also had the surprising benefit of being loaded with world Excel tricks that I’d never seen before, particularly for calculations involving loans.

Overall, I’m very glad I made the decision to study at the Harvard Extension School. But what about those dangerous courses I alluded to? I’m going to be publishing two more articles in the coming weeks on this site talking about the less amazing sides of my Harvard experience. Does Harvard teach academic financial theories that don’t work in the real world? And did doing the opposite of what one of my professors encouraged lead to a 200+% investing profit? Shockingly, the answer is yes to both, subscribe to my email list and you’ll be the first to know exactly what I’m talking about.